Under ASPE, the lessee evaluates a lease on a classification basis (i.e. where the risks and rewards are deemed to substantively pass to the lessee as evidenced by the criteria below). Later in this chapter, IFRS 16 will be discussed which identifies another approach for lease evaluation, called the contract basis. More on that later.

Under ASPE, the lessee is to classify the lease as a capital lease if any one or more of the following criteria is met:

This sum is referred to as the minimum lease payment.

The interest rate used in the present value calculation is the lower of the lessor’s implicit rate if known, and the lessee’s incremental borrowing rate.

For points 2 and 3 above, consider that even though the leased asset’s title has not legally transferred to the lessee, the risks and rewards of ownership have been substantively transferred to the lessee, hence the accounting treatment to capitalize the lease asset, recognize the lease obligation, and record the leased asset depreciation and accrued interest on the lease obligation. This is an example of a case in which the economic substance, rather than the legal form, dictates the accounting treatment.

Special Note: For ASPE, the leased asset valuation amount cannot exceed its fair value at that date.

For the lessor classification as a capital lease, ASPE requires any one of the above three criteria for the lessee to be met, plus two additional criteria:

If these two additional criteria are not met, it would not be appropriate for the lessor to remove the leased asset from its accounting records.

Further analysis is required to determine if the lease is a sales-type lease, indicated by the existence of a profit, or if it is a direct-financing lease, which is usually the case when lessors are finance companies or banks and not manufacturers or dealers.

If the lease is deemed to be a capital lease, the lessor removes the asset from its leased assets inventory and records a receivable amount equal to the sum of the undiscounted lease payments, plus any guaranteed or unguaranteed residual value, or a bargain purchase option. The lessor must also record the lease as either a sale, if the fair value of the lease is greater than the cost of goods sold (a profit), or as a financing arrangement (no profit).

Indirect costs. Any initial direct costs of negotiating and arranging the acquisition of the lease are included in the lessor’s investment amount to be recovered when calculating the lease payment amount because the lease payment is intended to recover these costs.

Executory costs. Lease payments often include leased asset use costs that the lessor has paid and wants to recoup from the lessee, such as insurance, maintenance, licenses, or tax costs. These executory costs are to be excluded when calculating the present value of the lease asset and obligation, and separately recorded as an expense for the lessee. This is because these costs don’t arise from the acquisition of the leased asset, but rather from its use. For example, if the lease payment of $14,000 included $2,000 for insurance of the leased asset, the lessee’s journal entry would be:

Economic life versus lease term. The economic life of an asset is usually longer than the lease term. Depreciation of a leased asset by the lessee for a capitalized lease is based on whether the title of the leased asset transfers to the lessee. If the legal title remains with the lessor, and the leased equipment is returned to the lessor at the end of the lease term, and the depreciation period of the leased asset will be the lease term. If the legal title to the leased asset transfers to the lessee at the end of the lease term, or there is a bargain purchase option (BPO) or bargain renewal option, it is assumed that the lessee will exercise this option since the price of either a BPO or a bargain renewal option is significantly lower than the market price at that time. For this reason, a leased asset under these circumstances will be depreciated over its economic or useful life instead of over the lease term. This makes intuitive sense, given that the lessee intends to continue to use the asset beyond the lease term.

Interest rates. ASPE advocates the lower of either the lessor’s implicit rate (if known) or the lessee’s incremental borrowing rate. This is to ensure that an artificially high interest rate is not used to lower the present value enough to result in a classification as an operating lease. Recall from previous chapters regarding long-term debt that the higher the interest rate, the lower the present value of the debt obligation. Using an unrealistically high interest rate for a lease could reduce the present value of the lease to below the capitalization threshold criterion of 90% under the ASPE standard. This would enable management to avoid the requirement to classify the lease as a capital lease and to report the leased asset and lease obligation on the balance sheet. Management might be motivated to do this because a capital lease asset and liability will change the liquidity and solvency ratios that are often monitored by creditors.

Once an interest rate is selected, the accrued interest for the lessee and interest income for the lessor are calculated using the effective interest method discussed in the long-term debt chapter.

The accounting treatment is best explained using a numeric example. On January 1, 2021, Tweenix Corp. (lessee) entered into an agreement to lease a piece of landscaping equipment from Morganette Ltd. (lessor). The lease details are below:

| Non-cancellable lease term | 8 years |

| Lease bargain renewal option or a bargain purchase option | None – equipment |

| reverts back to lessor | |

| Residual value (not guaranteed by lessee) | $36,000 |

| Annual lease payment due each January 1 (annuity due) | Lessor to determine |

| Equipment cost to lessor | $666,000 |

| Equipment estimated economic life | 9 years |

| Equipment fair value on January 1, 2021 | $864,000 |

| Lessor has set the following implicit rate of return, which is known to lessee | 7% |

| Lessee incremental borrowing rate | 8% |

In this case, the lessor wants to get a return of 7% on the investment. Other negotiated details between the lessor and lessee result in a lease term of eight years, no bargain purchase or bargain renewal options, with the leased asset reverting back to lessor at the end of the lease term. The lessee does not guarantee the residual value of $36,000 at the end of the lease term in this case. The equipment originally cost $666,000 and has a current fair value of $864,000. The lessor must now calculate the lease payment amount that the lessee will pay at the beginning of each year which will enable the lessor to recoup the investment cost plus a return on investment. Because the lease payments will be made at the beginning of each year, the payment calculation using present values and a financial calculator will be for an annuity due (AD). This means that, in this example, the lease payment is to be made at the beginning of each year instead of at the end. The annuity due concept was discussed in further detail in the chapter on long-term debt under present values and timelines.

The variables used to calculate present value of the the lease payment amount include a 7% expected rate of return (I/Y), the $864,000 fair value as the present value (PV) of the equipment, the eight years duration of the arrangement (N), and the $36,000 unguaranteed residual value (FV) that the lessor hopes to receive by reselling the used equipment in the marketplace at the end of the lease term.

Recall that when calculating the lease payment, it does not matter if the residual value is guaranteed or not guaranteed by the lessee because the residual value represents a cash flow in, no matter the source because the lease payment calculation is from the lessor’s point of view. The present value calculation of the lease payment (annuity) using a financial calculator is:

| = |

The lease payment will be $131,947 per year for eight years for the lessor to recoup the asset’s fair value of $864,000, earn a 7% return, and recoup a residual value of $36,000 from the marketplace at the end of eight years. The unguaranteed residual value that the lessor expects to receive once the leased asset is sold in the marketplace at the end of the lease term causes the lease payment amount for the lessee to be reduced. Had there been no residual value, the lessee’s lease payment amount would be for a higher amount of $135,226 (+/- 864,000 PV, 7 I/Y, 8 N, 0 FV).

The terms of the lease agreement are now set, and it is time to determine whether the lease is to be classified as an operating or capital lease by both parties. Since these companies follow ASPE, this will be the criteria used.

As previously stated, at least one of the four criteria below must be met for the lease to be classified as capital, otherwise it will be classified as an operating lease. Below, highlighted in red, are the results of the analysis for this example:

![]()

Note: At this point, as one of the criteria has been met, the capitalization classification of the lease is now applicable, but the lessee analysis will continue to include the fourth criteria for illustrative purposes.

| The lease cash flows = | lease payment |

| guaranteed residual value | |

| BPO | |

| executory costs paid by lessee included in the $131,947 lease payment |

The interest rate is the lower of the lessor’s implicit rate (7%) which is known to the lessee or the lessee’s incremental borrowing rate (8%).

Present value calculation of the minimum lease payments:

| PV | = |

| = rounded |

* The residual value is not guaranteed by the lessee so it is not included in the lessee’s present value calculation.

The fair value of the leased asset is $864,000, so the present value of the net cash flows is 97.575% and is greater than the threshold criterion of 90%. The present value of $843,048 is lower than the fair value amount of $864,000. The leased asset and the associated lease obligation will be the amount of the present value of the lessee’s minimum lease payments of $843,048. For the lessee, the analysis reveals that this lease meets two of the criteria for capitalization. Since only one needs to be met, the lessee will classify this lease as a capital lease.

The criteria above are also used to determine if the lease is to be a capital lease for the lessor, plus two additional criteria, and both of these must be met to be a capital lease:

The lessor must now determine if the lease is to be treated as a sales-type lease or a direct-financing lease. In this case, the fair value of the lease of $864,000 exceeds the lessor’s cost of $666,000, meaning that a profit exists which classifies this as a sales-type lease. To summarize the analyses above, if the lease meets the criteria for capitalization for the lessee, it will also be classified as a capital lease for the lessor, provided that there are no collectability issues or uncertainties about un-reimbursable costs. For the accounting treatment, in summary:

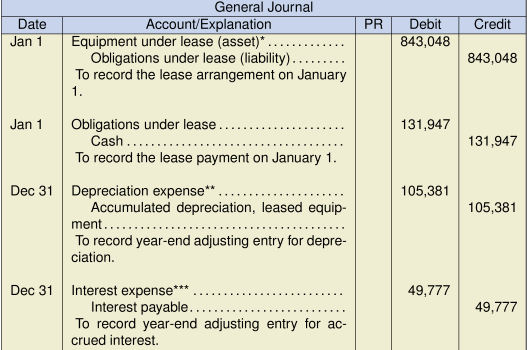

* PV = (131,947 PMT/AD, 7 I/Y, 8 N, 0 FV)

** 843,048 lease asset amount divided by 8 years lease term if SL depreciation policy is used.

*** ![]()

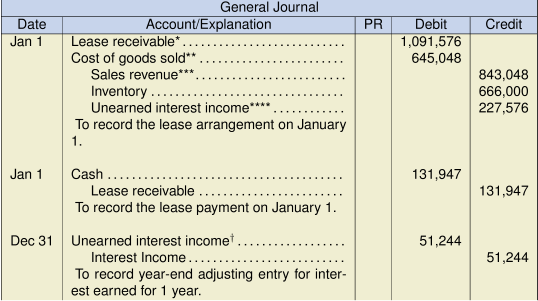

* ![]()

Since the residual value is not guaranteed by the lessee, its present value is excluded from both COGS and sales as shown below:

** ![]()

PV = (7 I/Y, 8 N, 36,000 FV) = 20,952

*** ![]()

**** ![]()

![]()